There’s a lot to love about credit unions! As a CUSO, or Credit Union Service Organization, we’re owned by credit unions and we’ll admit our opinion is a tiny bit biased. We really think the facts back up this opinion, though! Check out this list of 4 great benefits that credit unions offer over a traditional bank, though, and we think you’ll find a lot to like as well:

#1 Credit Unions are Nonprofit Organizations

The biggest advantage your local credit union will offer you is that it’s a nonprofit organization. That means there’s less incentive for them to raise lending interest rates as high as possible, and they’ll often pay a higher yield for deposits as well. Credit unions are owned by their members, and built from the ground up to serve their community rather than shareholders. When you work with a financial institution that isn’t motivated by profit, meeting your needs becomes the priority. You’ll see the difference it makes in every interaction you have with your credit union!

#2 Credit Unions Have Better Customer Service

Better customer service is built into the DNA of credit unions! In 1934, the Federal Credit Union Act was signed into law to give people another choice in addition to banks for their financial needs, and from the start credit unions have made customer service a top priority. When a credit union is improving the lives of their members and their community, it is doing exactly what it was designed to do, even if there isn’t a profit being made. This simply isn’t true for banks, and that difference in priorities makes providing excellent customer service integral, not optional, to how credit unions operate.

#3 Credit unions make it easier to purchase a home

As a CUSO, Mortgage Center is dedicated to working with our credit union partners and their members to improve our communities. Whereas banks can feel like a barrier to realizing the dream of homeownership, especially for people with less-than-stellar credit or limited down payment funds, we focus on opening doors. We’ll work with you to understand your goals and your individual circumstances and come up with a plan together to accomplish your goals. This kind of individualized approach makes it more likely that we can come up with a home loan that works for you, and it’s simply not something you can expect from a big bank.

#4 Credit Unions Save You Money

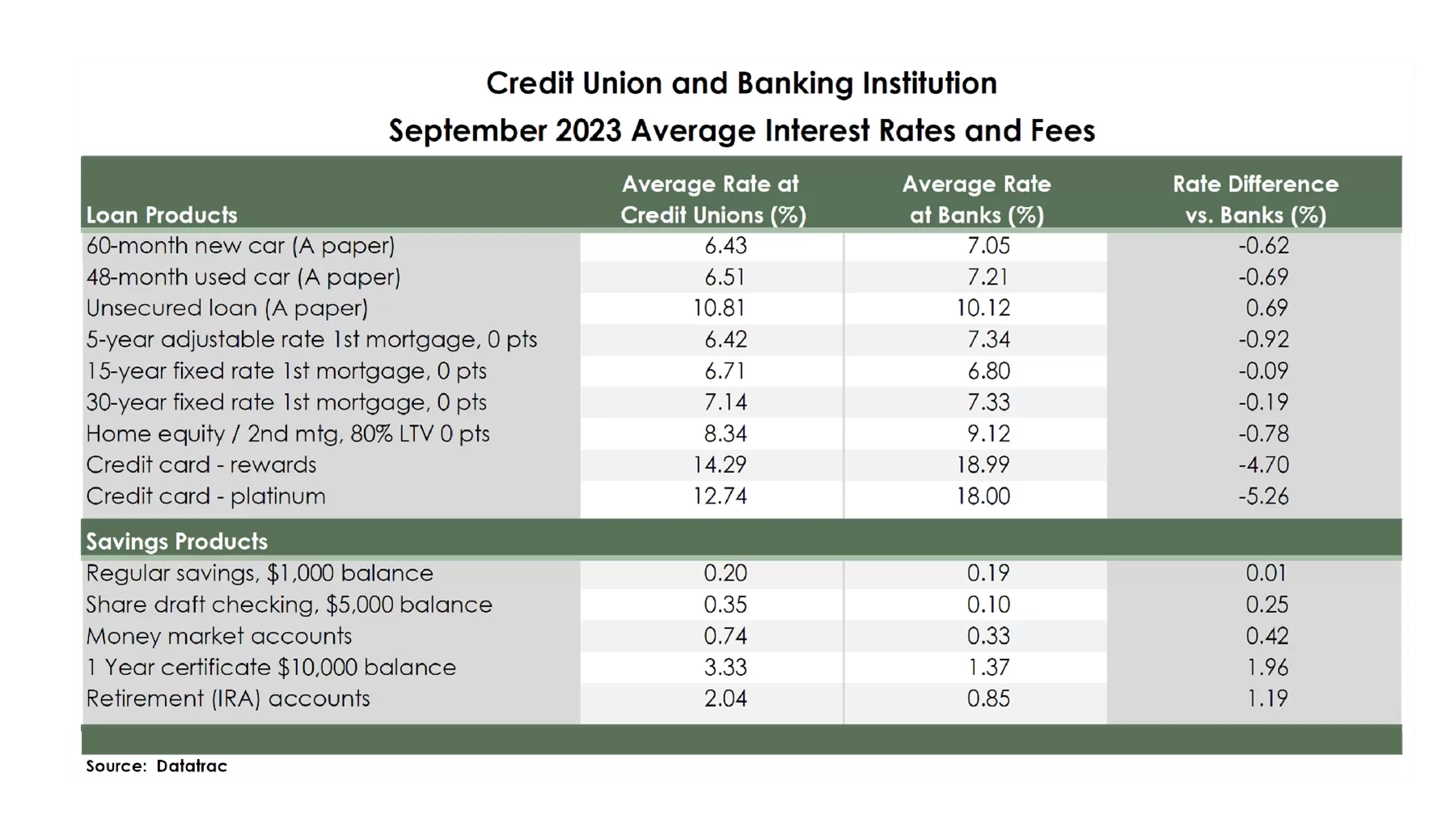

Remember that part about credit unions being run as nonprofits? That doesn’t just mean they fill out a different set of forms for their taxes, it means that once the bills and employees have been paid, a credit union’s profits are given back to their members, usually in the form of better interest rates and lower fees. At the end of the day, CU’s make sure that more money stays in your pocket, while still providing stellar customer service. The numbers don’t lie, check out the chart below for yourself.